Academy Mortgage

Setting the Tone for Academy Mortgage

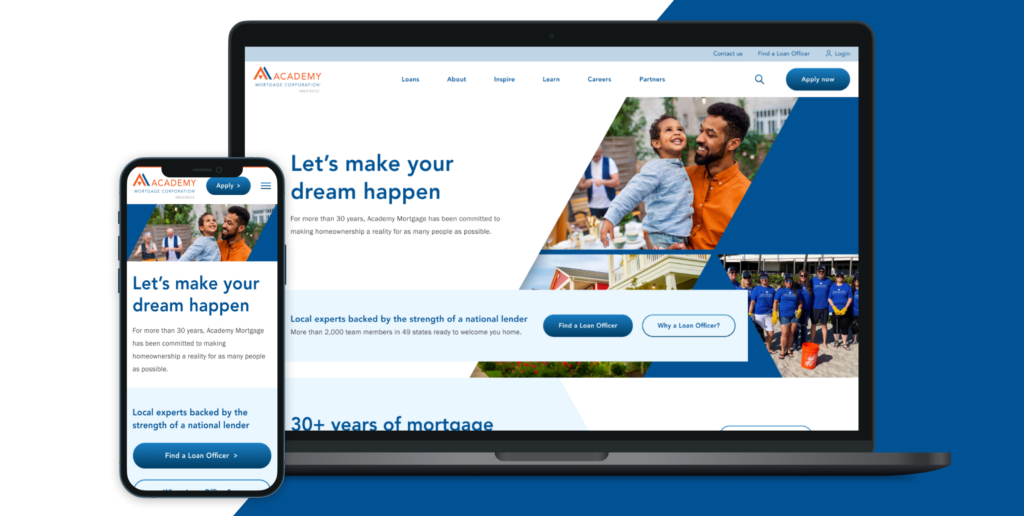

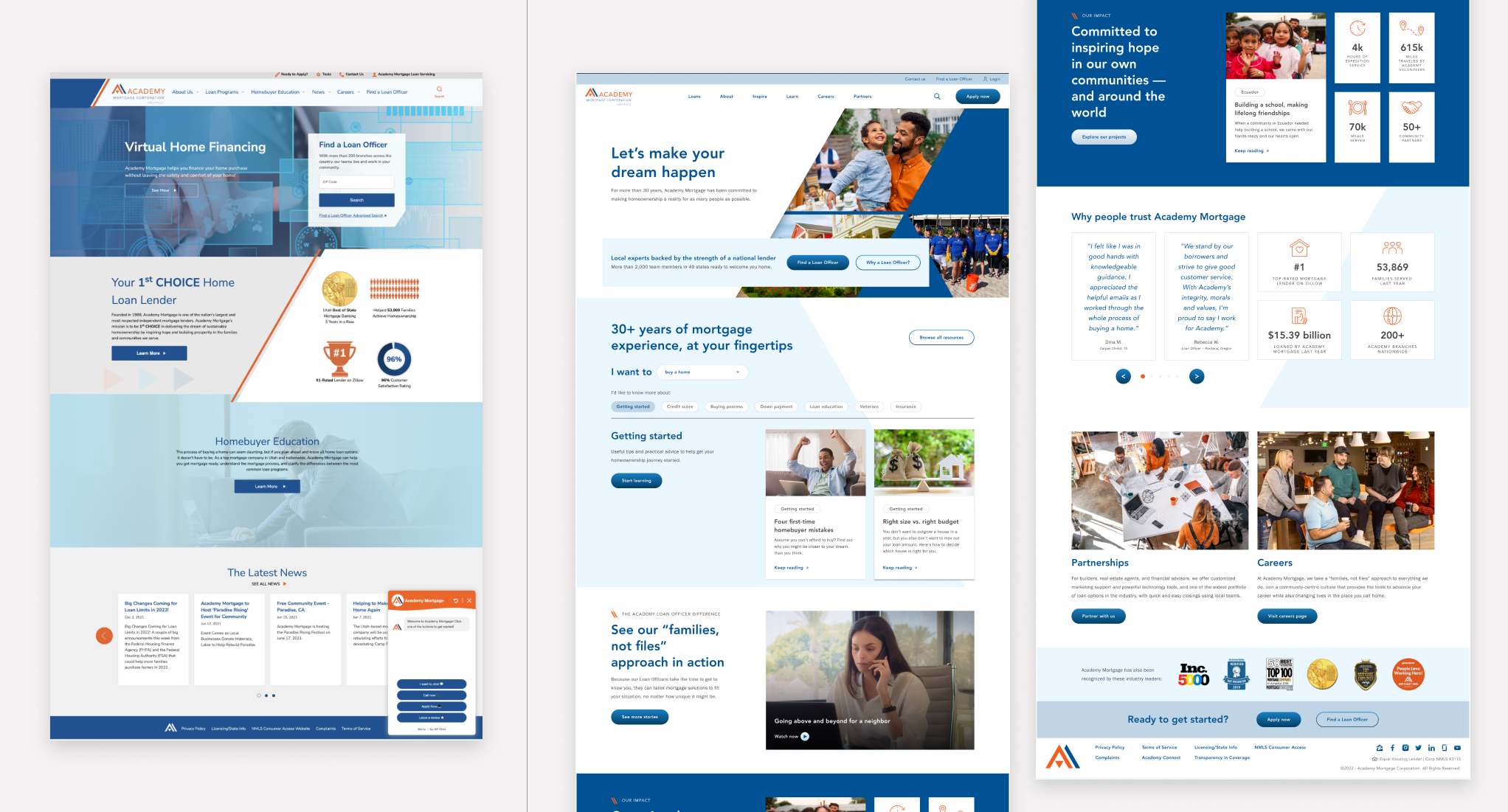

Academy Mortgage primarily sourced potential clients through word of mouth and in-person workshops. The company aimed to transform the mortgage application experience through personalization and digitizing the process. Notable players in the mortgage space, such as Rocket Mortgage and Better Mortgage, has reshaped the landscape by embracing digital transformation. Beyond being a mortgage provider, Academy Mortgage took pride in assisting low-income families in securing permanent residences. The shift from Academy's traditional business model to a digitally-oriented approach was essential for uncovering new avenues to reach a broader client base.

The Design Process

Starting with Competitive Research

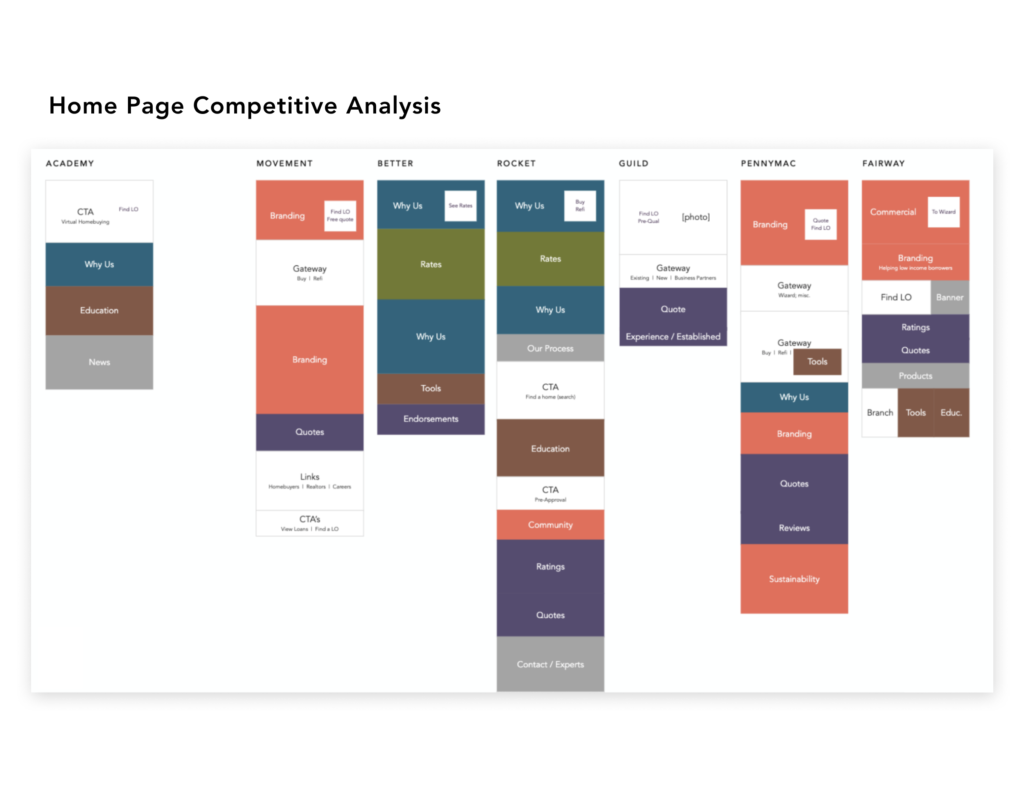

Pioneers in the mortgage market, Better Mortgage and Rocket Mortgage have spearheaded digital transformation, streamlining the mortgage application process for enhanced efficiency. Our analysis predominantly centered on these two industry leaders, seeking to identify any competitive gaps and potential opportunities. Additionally, Movement Mortgage emerged as a notable competitor for Academy, sharing a similar emphasis on community and social impact.

Main insights gathered from the analysis:

- A present loan officer that follows throughout the experience of the website in case the user needs to ask a question or reach out for a quote.

- Educating the user on loan types and the mortgage process.

- Transparently displaying loan rates and calculators to help inform.

Identifying the Target Audience

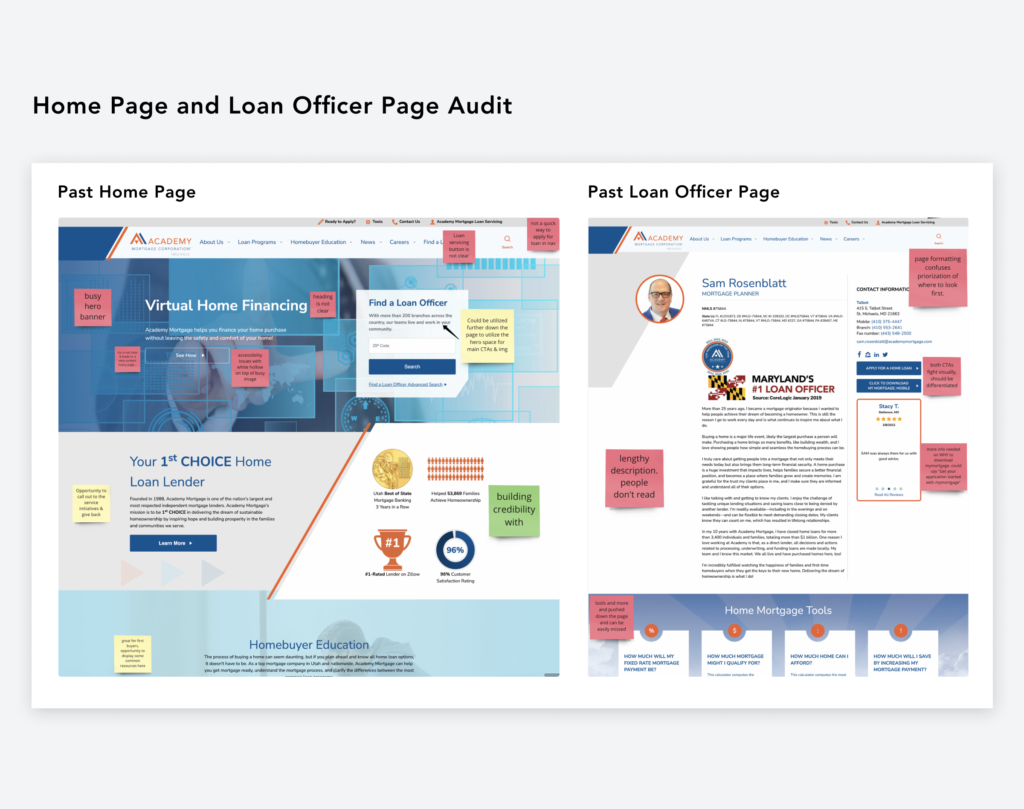

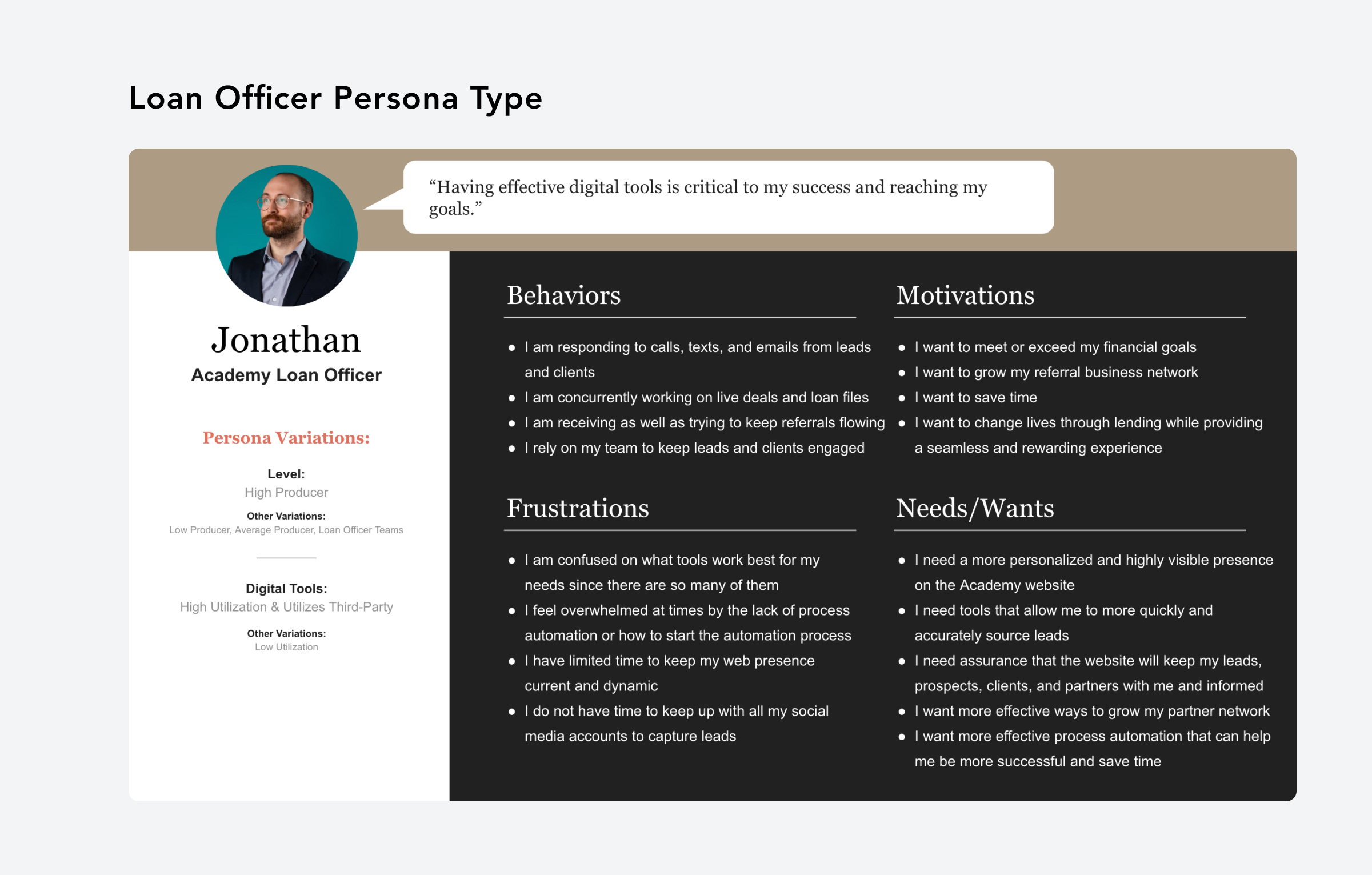

Loan officers play an important role at Academy as they handle the responsibility for acquiring clients and promoting loan sales. Ensuring that loan officers could independently create and personalize their landing pages became imperative. This meant that loan officer persona types were just as vital as potential customers. Many loan officers resorted to developing their individual websites externally due to the limitations of Academy's website in terms of full customization. Our team noted issues by conducting loan officer interviews to identify needs and pain points. Making sure loan officers had full access to their Academy Mortgage domain was crucial to making sure customers also had a positive experience too since loan officers facilitate the mortgage process with customers.

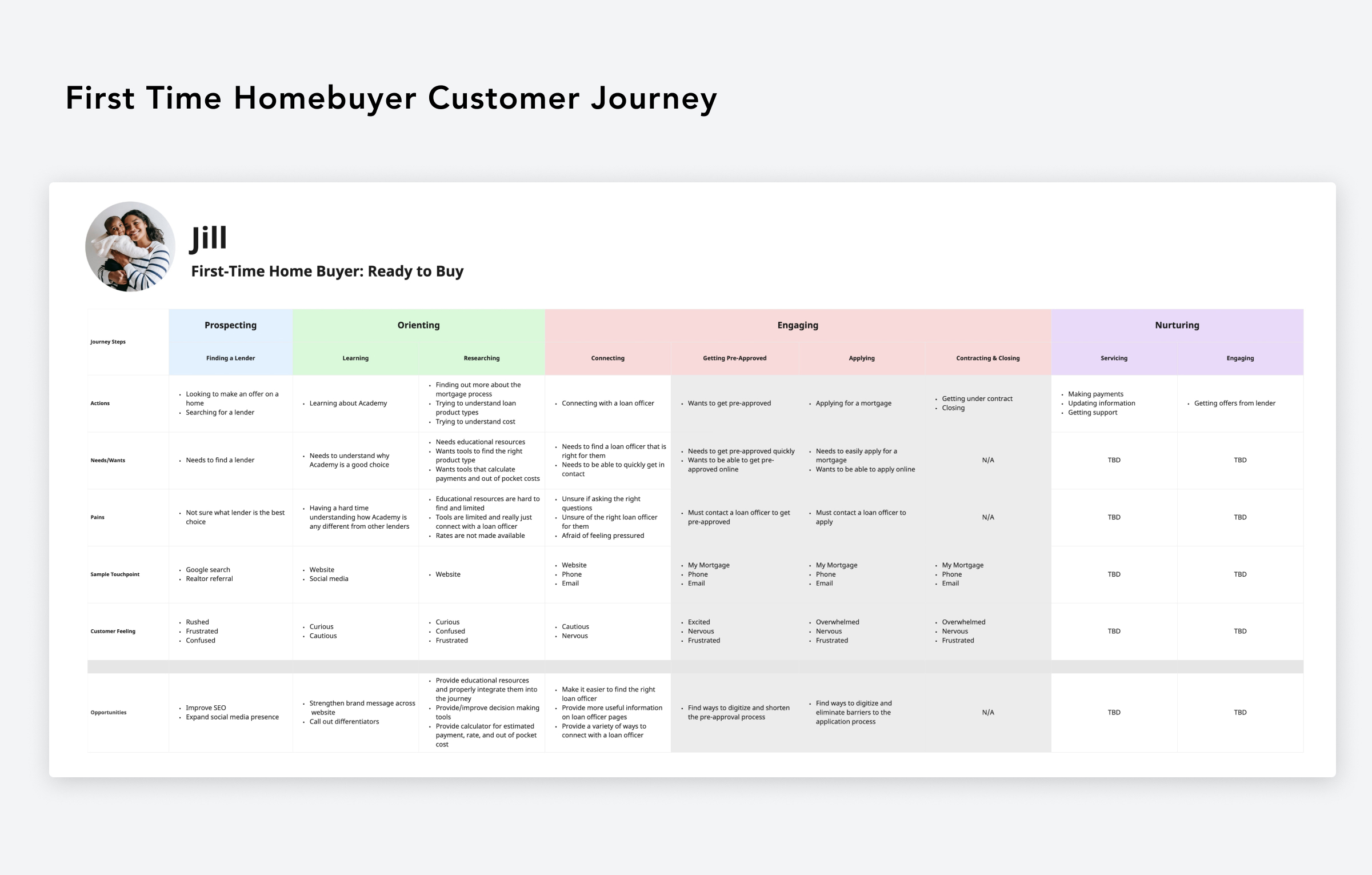

Customer Journey Mapping

The UX team pinpointed pain points and customer needs by conducting interviews with loan officers and gathering insights from customer surveys. Using journey maps, they identified the essential tools and resources required to alleviate these pain points. The primary goals for the website encompassed integrating features like calculators, a robust resource center, and transparent rate information. Additionally, four distinct journey maps were created, aligning with different persona types. This approach enabled us to gain a comprehensive understanding of our audience's needs for the website.

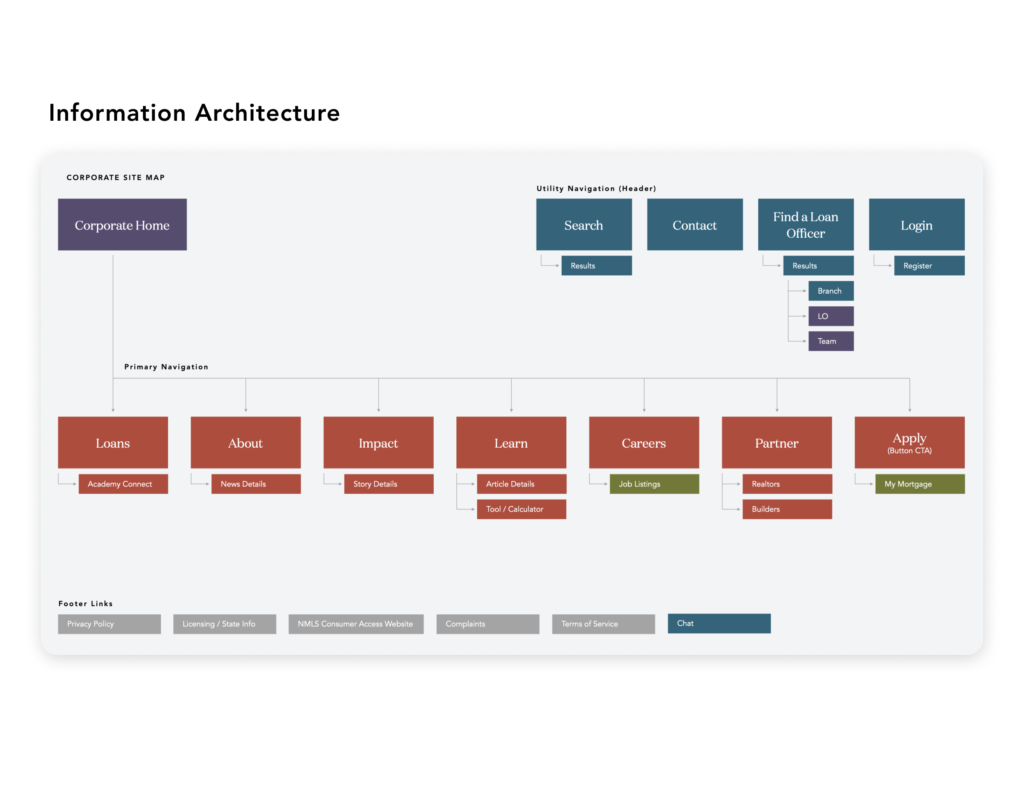

Developing the Information Architecture

Implementing an information architecture for my project helped create a systematic outline for content organization and laid the foundation for a coherent sitemap. Prior to this initiative, the navigation and tagging structure were disorganized, resulting in a challenging web experience for customers. By strategically designing the information architecture, we were able to categorize and structure content in a logical manner, enhancing the overall usability and clarity of the website.

The team conducted an open card sort workshop with the client to visually outline the primary categories of information. The objective was to maintain simplicity and conciseness in defining the main buckets, employing single words to ensure the navigation is both action-oriented and clear. This approach enhances user interaction by providing straightforward and easily understandable pathways through the content.

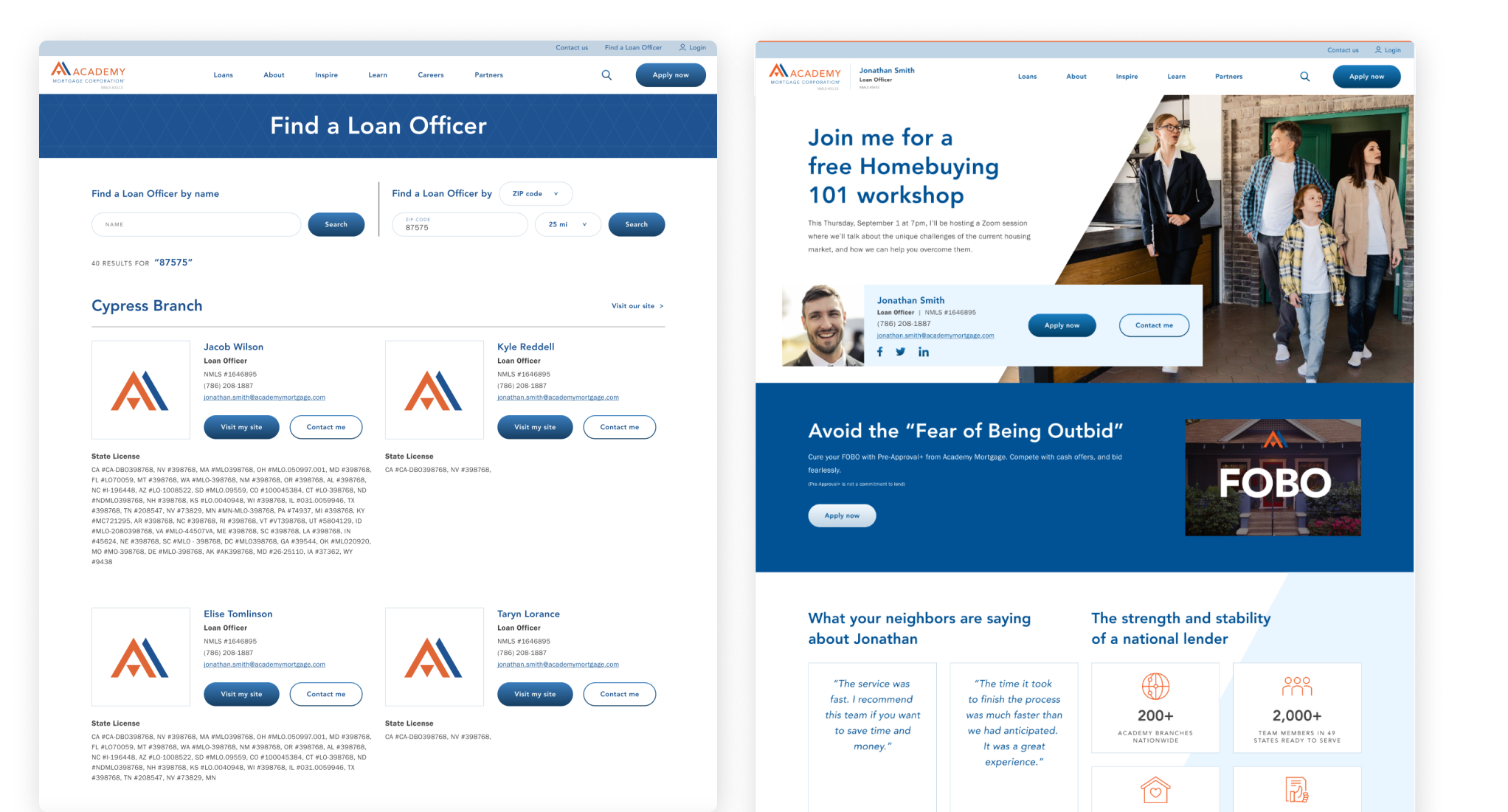

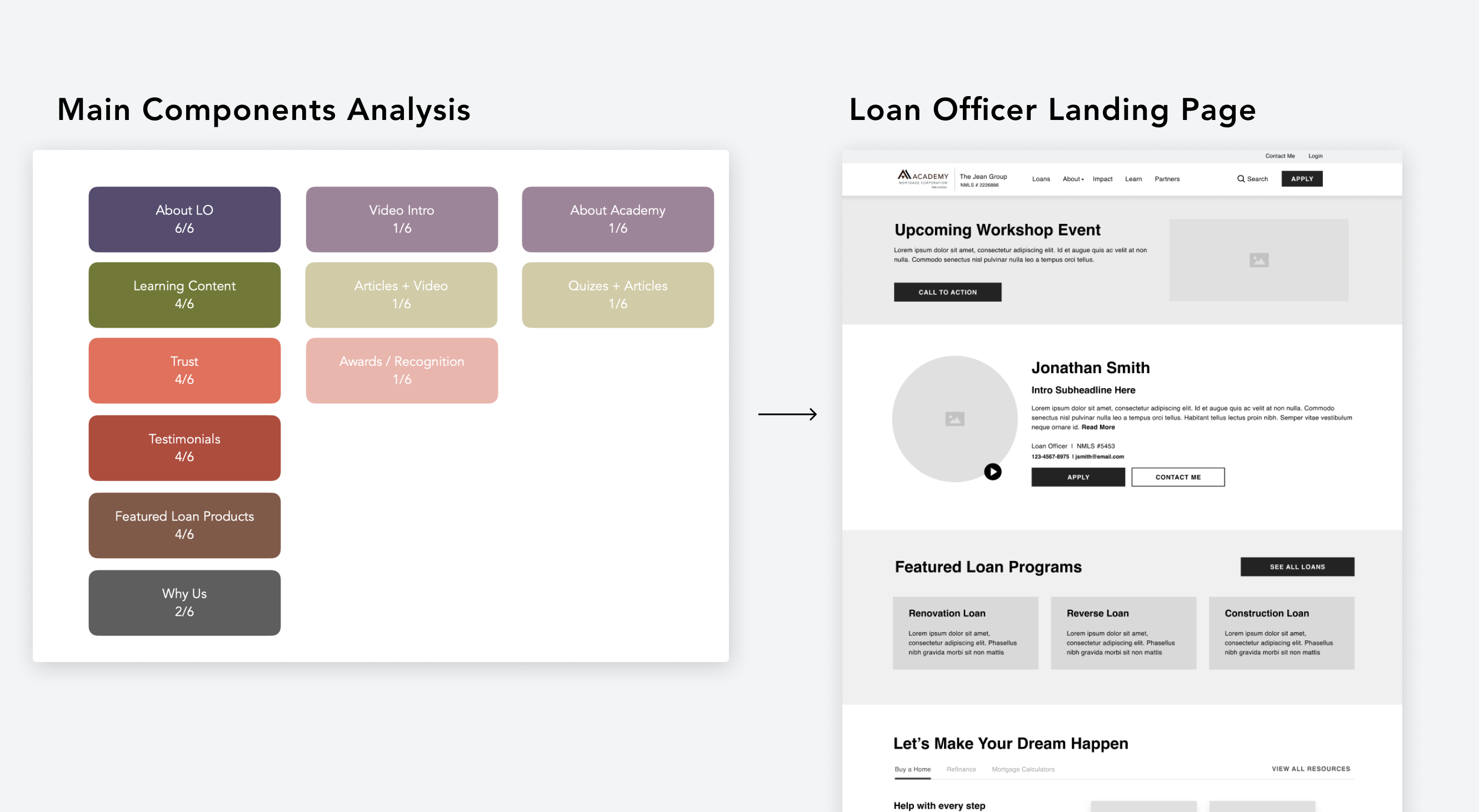

Loan Officer Page Templates

Recognizing the need for a more cohesive online presence, our team took the initiative to develop dedicated landing page templates for loan officers, a functionality that was notably absent. Loan officers were left to individually create their own websites, resulting in a lack of visual consistency for Academy Mortgage. Through a series of interviews, we gathered valuable data to understand the specific needs and preferences of loan officers. The insights collected shaped the design of the templates, emphasizing key content elements such as resources, loan programs, and testimonials.

Visualizing Personalization

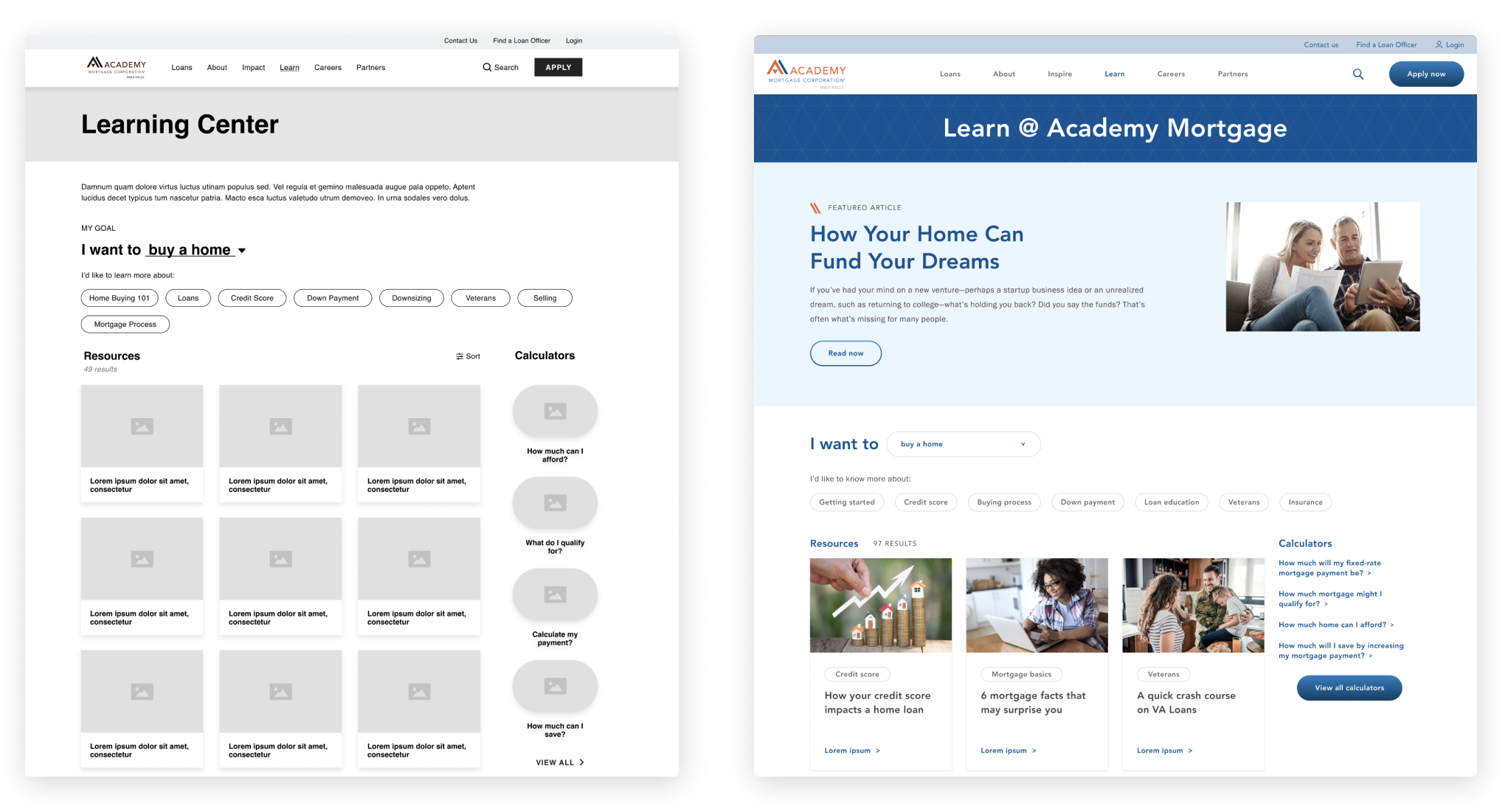

Serving Up Relevant Resources To Home Buyers

A pivotal stage in the mortgage journey revolves around education, as it involves acquiring the necessary knowledge to initiate a mortgage application and determine the most suitable loan. Our focus zeroed in on the learning center, where articles, spanning from “Where to Start” to “How do I Refinance,” resides. Departing from conventional filters for sifting through article cards, we opted for a more conversational approach to article discovery. The process begins by identifying the user’s goal, followed by the presentation of related filters tailored to that goal. This conversational methodology not only streamlines the search for articles but also adds a personal touch to the user’s navigation, creating a more engaging and personable experience. For instance, if a user indicates they are “looking to buy a house soon,” relevant articles seamlessly appear throughout the user’s journey on the site.

A Selected Loan Officer Is Always Present

A challenge faced by customers was the potential loss of a loan officer’s information once they digitally selected a loan officer to proceed with. Conversely, loan officers could miss out on prospects if customers failed to recall their information, prompting them to seek assistance from another loan officer. To address this issue, we devised a solution: allowing the presence of a loan officer to be optional throughout the site experience. This approach fosters a more reliable and trustworthy experience for customers, assuring them that their designated loan officer is readily available to offer assistance whenever needed.